OS :

Version :6.2.0

Size :121.41Mb

Updated :Nov 8,2022

Developer :FloatMe

Ask AI

Ask AIYou can ask

the AI some questions about the app

Based on the app's description, here are three topics that users may discuss online, turned into questions:

1. Is the floatMe app secure for users to borrow money and pay back with interest?

2. How does the floatMe app assess creditworthiness and determine loan amounts for users?

3. Are there any hidden fees or charges associated with using the floatMe app for instant cash advances?

Pros and Cons from users' feedback

After analyzing the reviews of FloatMe: Instant Cash on the Apple App Store, I've compiled a list of five points of pros and cons to help you make an informed decision.

2Easy to use: The app's interface is user-friendly, and users appreciated the simplicity of the application process.

3Helpful customer support: Some reviewers mentioned that the customer support team was responsive and helpful in resolving issues.

4Flexible repayment options: FloatMe allows users to repay their advances over time, which was seen as a positive feature by many reviewers.

5Low fees: Compared to other similar apps, FloatMe's fees were considered reasonable by many users.

2Credit score impact: A few users reported that their credit scores were negatively affected after using the app, which was a concern for them.

3Limited availability: FloatMe is not available in all states, which may be a limitation for some users.

4Customer service issues: A small number of reviewers experienced difficulties when trying to contact customer support, which led to frustration.

5Lack of transparency: Some users felt that the app's terms and conditions were unclear, leading to confusion about the fees and repayment terms.

Overall, while FloatMe has received positive reviews for its convenience and ease of use, some users have expressed concerns about the high interest rates, credit score impact, and limited availability. It's essential to carefully review the app's terms and conditions before using it to ensure it's a good fit for your financial situation.

Pros:

1Fast and convenient: Many users praised the app's ability to provide instant cash advances, with some reporting receiving funds within minutes.2Easy to use: The app's interface is user-friendly, and users appreciated the simplicity of the application process.

3Helpful customer support: Some reviewers mentioned that the customer support team was responsive and helpful in resolving issues.

4Flexible repayment options: FloatMe allows users to repay their advances over time, which was seen as a positive feature by many reviewers.

5Low fees: Compared to other similar apps, FloatMe's fees were considered reasonable by many users.

Cons:

1High interest rates: Some reviewers felt that the interest rates charged by FloatMe were too high, which added to the overall cost of the advances.2Credit score impact: A few users reported that their credit scores were negatively affected after using the app, which was a concern for them.

3Limited availability: FloatMe is not available in all states, which may be a limitation for some users.

4Customer service issues: A small number of reviewers experienced difficulties when trying to contact customer support, which led to frustration.

5Lack of transparency: Some users felt that the app's terms and conditions were unclear, leading to confusion about the fees and repayment terms.

Overall, while FloatMe has received positive reviews for its convenience and ease of use, some users have expressed concerns about the high interest rates, credit score impact, and limited availability. It's essential to carefully review the app's terms and conditions before using it to ensure it's a good fit for your financial situation.

After analyzing the reviews of "FloatMe: Instant Cash" on the Apple App Store, I've compiled a list of five points of pros and cons to help you make an informed decision.

**Pros:**

1. **Fast and convenient**: Many users praised the app's ability to provide instant cash advances, with some reporting receiving funds within minutes.

2. **Easy to use**: The app's interface is user-friendly, and users appreciated the simplicity of the application process.

3. **Helpful customer support**: Some reviewers mentioned that the customer support team was responsive and helpful in resolving issues.

4. **Flexible repayment options**: FloatMe allows users to repay their advances over time, which was seen as a positive feature by many reviewers.

5. **Low fees**: Compared to other similar apps, FloatMe's fees were considered reasonable by many users.

**Cons:**

1. **High interest rates**: Some reviewers felt that the interest rates charged by FloatMe were too high, which added to the overall cost of the advances.

2. **Credit score impact**: A few users reported that their credit scores were negatively affected after using the app, which was a concern for them.

3. **Limited availability**: FloatMe is not available in all states, which may be a limitation for some users.

4. **Customer service issues**: A small number of reviewers experienced difficulties when trying to contact customer support, which led to frustration.

5. **Lack of transparency**: Some users felt that the app's terms and conditions were unclear, leading to confusion about the fees and repayment terms.

Overall, while FloatMe has received positive reviews for its convenience and ease of use, some users have expressed concerns about the high interest rates, credit score impact, and limited availability. It's essential to carefully review the app's terms and conditions before using it to ensure it's a good fit for your financial situation.

App

Downloads

>

App

Survey

- Do you think the stability of the application affects the experience?

- Application technology innovation Does it affect the experience?

- Does the feedback of the application affect the experience?

- How much time do you spend on app applications every day?

Description

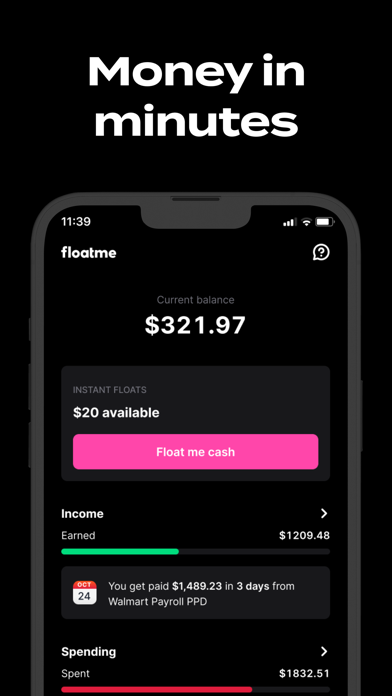

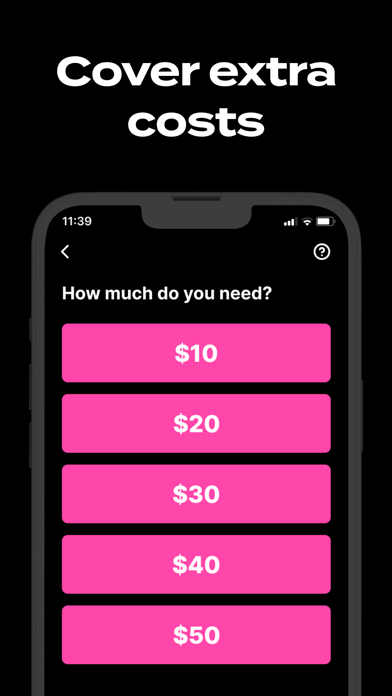

Pay bills, pay rent, or buy groceries. Get cash when you need it most. No credit check and no interest.

*FloatMe does not support prepaid cards and Chime or Varo accounts at this time.*

--

The best friend your bank never had.

Access to cash when you need it most.

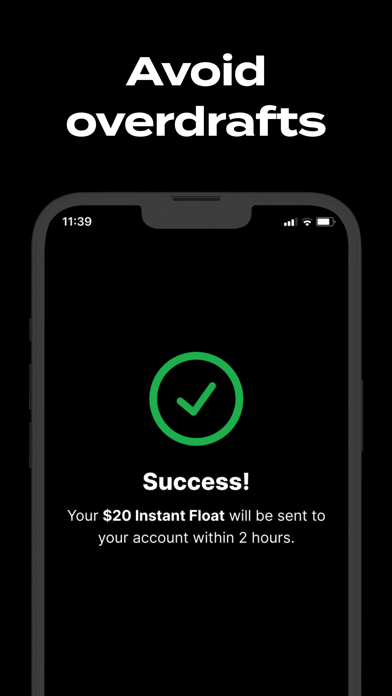

Stop overdrafts.

--

FloatMe helps hard-working employees get ahead on their finances with overdraft alerts and access to emergency cash.

For just $1.99/ mo, plus a free 7-day trial, you can access a variety of features, including small cash advances of up to $50, overdraft alerts, and FloatMeEDU.

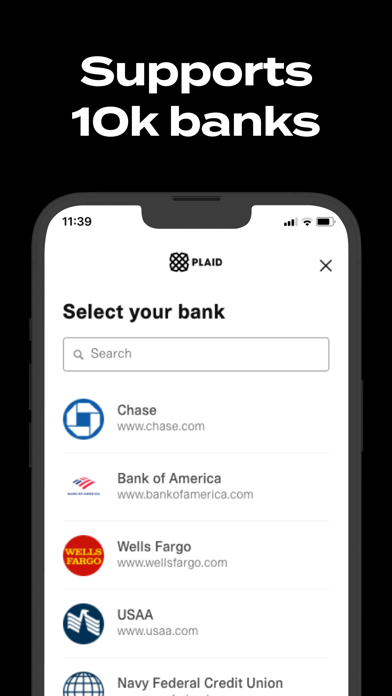

Our advances are interest-free, our sign-up process is simple, and we work with Bank of America, Wells Fargo, Chase, Navy Federal Credit Union, USAA, and over 9,600+ more banking institutions to make the process as seamless as possible using 256-bit bank-grade security.

Get started with a free trial in just 2 minutes.

Our mission is to help people make better financial decisions and this is just the start. Welcome to a better financial future with FloatMe!

Questions?

You can contact us through our support portal at https://floatme.zendesk.com

Comments (0)

0/255

Developer apps

Category Top

apps

- Google Play

- App Store

More Apps

Ask AI

Ask AI