OS :

Version :6.3.2/6.2

Size :/31.80Mb

Updated :Nov 10,2022

Jan 28,2022

Jan 28,2022

Developer :NetSpend

Ask AI

Ask AIYou can ask

the AI some questions about the app

Here are three potential topics of discussion about the NETSPEND app, turned into questions for you:

1. Is the app user-friendly and easy to navigate, even for those who are not tech-savvy?

2. Are the fees associated with using the app reasonable and transparently disclosed?

3. Do the rewards and benefits offered by the app align with your shopping habits and spending priorities?

Pros and Cons from users' feedback

After analyzing the reviews, here are three cons and pros of the app:

2Easy to set up and use, with clear instructions and minimal technical issues reported.

3Helpful customer support team efficiently resolves issues and addresses concerns.

2Limited customization options for account management and settings, leading to frustration.

3Occasional app crashes or freezes, disrupting the seamless payment experience.

Pros:

1Convenient mobile payment option for HEB debit card users, saving time and effort.2Easy to set up and use, with clear instructions and minimal technical issues reported.

3Helpful customer support team efficiently resolves issues and addresses concerns.

Cons:

1Some users experience difficulties linking their debit card to the app, requiring multiple attempts.2Limited customization options for account management and settings, leading to frustration.

3Occasional app crashes or freezes, disrupting the seamless payment experience.

After analyzing the reviews, here are three cons and pros of the app:

**Pros:**

1. Convenient mobile payment option for HEB debit card users, saving time and effort.

2. Easy to set up and use, with clear instructions and minimal technical issues reported.

3. Helpful customer support team efficiently resolves issues and addresses concerns.

**Cons:**

1. Some users experience difficulties linking their debit card to the app, requiring multiple attempts.

2. Limited customization options for account management and settings, leading to frustration.

3. Occasional app crashes or freezes, disrupting the seamless payment experience.

>

App

Survey

- The degree of memory and power consumption Does it affect the experience?

- Does the frequency of application notifications affect the experience?

- Whether the application ad recommendation affects the experience?

- Ease of use of the application Does it affect the experience?

Description

Account opening is subject to registration and ID verification.¹

Say hello to the H-E-B® Debit Account, a great way to pay from a company Texans have trusted since 1905. Some of the benefits include:

• Earn 5% cash back on H-E-B brand products² when you use the H-E-B Debit card.

• There is no monthly fee to maintain your account.

• Short on funds? With qualifying Direct Deposit, our Purchase Cushion³ may cover you up to $20 if you fall a little short. (Resolve negative balances within 30 days by adding funds to your account.)

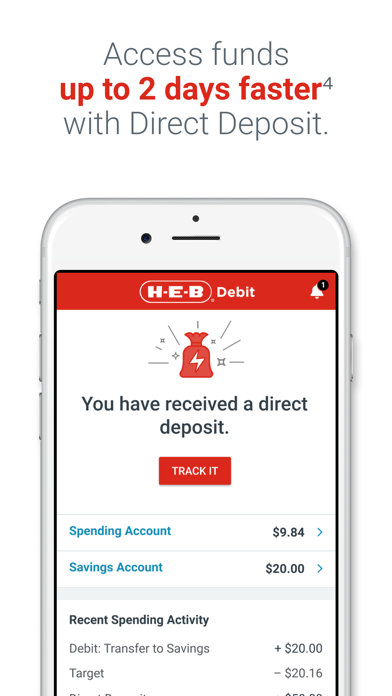

• Access funds up to 2 days faster⁴ with Direct Deposit.

• Free cash withdrawals at H-E-B ATMs.⁵

• Add funds to your account at no-cost⁶ by visiting the H-E-B Customer Service Center or checkout.

Visit hebdebit.com to learn more.

1 ID verification required. We will ask for your name, address, date of birth, and your government ID number. We may also ask to see a copy of your driver’s license or other documents at any time.

2 5% cash back applies only to H-E-B brand products purchased at an H-E-B store register or heb.com using your H-E-B Debit Card issued by Pathward, National Association. 5% cash back is limited to the amount of the purchase paid for using your H-E-B Debit Card. Not valid on purchases at Central Market®, Mi Tienda®, Joe V’s Smart Shop®, or through Favor®. No cash back for pharmacy prescriptions, gift cards, restaurants, fuel, car washes, purchases made on the H-E-B Go app or at H-E-B Go kiosks, or purchases at mobile point-of-sale systems deployed in store. Cash back will be credited to your available balance within 7 business days after applicable purchase. Cash back offer by H-E-B. Pathward, N.A., Mastercard, and Netspend do not sponsor, and are not affiliated with the offer.

3 The $20 Purchase Cushion is not an extension of credit. To be eligible, Accountholder must have

received qualifying Direct Deposits of paychecks and/or government benefits payments totaling at least $500.00 within one (1) calendar month. See the Deposit Account Agreement for details.

4 Faster funding claim is based on a comparison of the Pathward, National Association, policy of making funds available upon receipt of payment instruction versus the typical banking practice of posting funds at settlement. Fraud prevention restrictions may delay availability of funds with or without notice. Early availability of funds requires payor’s support of direct deposit and is subject to the timing of payor’s payment instruction.

5 Free ATM withdrawals at H-E-B branded ATMs (“in-network ATMs”) in the US. Visit your Online Account Center for a list of in-network ATMs. Transactions at all non-H-E-B branded ATMs are $2.95, operator may assess additional charges.

6 There is no fee to add funds at participating H-E-B locations for the H-E-B® Debit Account. See the Deposit Agreement for details and additional fees.

The H-E-B® Debit deposit account and H-E-B Debit Card are established by Pathward, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Netspend is a service provider to

Pathward, N.A. Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787.

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Card may be used everywhere Debit Mastercard is accepted.

© 2022 Netspend Corporation. All rights reserved worldwide. Netspend is the federally registered U.S. service mark of Netspend Corporation. All other trademarks and service marks belong to their owners.

Google Play and the Google Play logo are trademarks of Google LLC.

Say hello to the H-E-B® Debit Account, a great way to pay from a company Texans have trusted since 1905. Some of the benefits include:

• Earn 5% cash back on H-E-B brand products² when you use the H-E-B Debit card.

• There is no monthly fee to maintain your account.

• Short on funds? With qualifying Direct Deposit, our Purchase Cushion³ may cover you up to $20 if you fall a little short. (Resolve negative balances within 30 days by adding funds to your account.)

• Access funds up to 2 days faster⁴ with Direct Deposit.

• Free cash withdrawals at H-E-B ATMs.⁵

• Add funds to your account at no-cost⁶ by visiting the H-E-B Customer Service Center or checkout.

Visit hebdebit.com to learn more.

1 ID verification required. We will ask for your name, address, date of birth, and your government ID number. We may also ask to see a copy of your driver’s license or other documents at any time.

2 5% cash back applies only to H-E-B brand products purchased at an H-E-B store register or heb.com using your H-E-B Debit Card issued by Pathward, National Association. 5% cash back is limited to the amount of the purchase paid for using your H-E-B Debit Card. Not valid on purchases at Central Market®, Mi Tienda®, Joe V’s Smart Shop®, or through Favor®. No cash back for pharmacy prescriptions, gift cards, restaurants, fuel, car washes, purchases made on the H-E-B Go app or at H-E-B Go kiosks, or purchases at mobile point-of-sale systems deployed in store. Cash back will be credited to your available balance within 7 business days after applicable purchase. Cash back offer by H-E-B. Pathward, N.A., Mastercard, and Netspend do not sponsor, and are not affiliated with the offer.

3 The $20 Purchase Cushion is not an extension of credit. To be eligible, Accountholder must have

received qualifying Direct Deposits of paychecks and/or government benefits payments totaling at least $500.00 within one (1) calendar month. See the Deposit Account Agreement for details.

4 Faster funding claim is based on a comparison of the Pathward, National Association, policy of making funds available upon receipt of payment instruction versus the typical banking practice of posting funds at settlement. Fraud prevention restrictions may delay availability of funds with or without notice. Early availability of funds requires payor’s support of direct deposit and is subject to the timing of payor’s payment instruction.

5 Free ATM withdrawals at H-E-B branded ATMs (“in-network ATMs”) in the US. Visit your Online Account Center for a list of in-network ATMs. Transactions at all non-H-E-B branded ATMs are $2.95, operator may assess additional charges.

6 There is no fee to add funds at participating H-E-B locations for the H-E-B® Debit Account. See the Deposit Agreement for details and additional fees.

The H-E-B® Debit deposit account and H-E-B Debit Card are established by Pathward, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Netspend is a service provider to

Pathward, N.A. Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787.

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Card may be used everywhere Debit Mastercard is accepted.

© 2022 Netspend Corporation. All rights reserved worldwide. Netspend is the federally registered U.S. service mark of Netspend Corporation. All other trademarks and service marks belong to their owners.

Google Play and the Google Play logo are trademarks of Google LLC.

Comments (3)

0/255

- SBy Sarvesh JadhavJul 29,2022

- GBy George RodriguezJun 30,2022

- JBy Juan Carlos ArrambidezJun 22,2022

- <

- 1

- >

Developer apps

- Google Play

- App Store

Category Top

apps

- Google Play

- App Store

More Apps

Ask AI

Ask AI