OS :

Version :3.8.1-20220817-RELEASE/3.10

Size :/146.20Mb

Updated :Aug 17,2022

Oct 6,2022

Oct 6,2022

Developer :Populus Financial Group, Inc.

Ask AI

Ask AIYou can ask

the AI some questions about the app

Here are three potential topics of discussion for the Porte Banking app, turned into questions for you:

1. How do you plan to use the app's budgeting features to track your spending habits and stay within your limits?

2. Have you experienced any issues with the app's security or login functionality, or do you have concerns about keeping your sensitive financial information safe?

3. How do you think the app's rewards and incentives program will motivate you to make better financial decisions and stick to your goals?

Pros and Cons from users' feedback

Based on the users' reviews of the Porte Banking app, here are three cons and three pros, each within a 15-word limit:

2Difficulty in cancelling subscriptions and unwanted charges reported.

3Limited features and functionality compared to other apps.

2Many praise the app's security and encryption features for safe transactions.

3Real-time updates and notifications keep users informed and in control.

Please note that these conclusions are based on a summary of the user reviews, and individual experiences may vary.

Cons:

1Many users complain about frequent login issues and app crashing.2Difficulty in cancelling subscriptions and unwanted charges reported.

3Limited features and functionality compared to other apps.

Pros:

1Users appreciate the user-friendly interface and easy account management.2Many praise the app's security and encryption features for safe transactions.

3Real-time updates and notifications keep users informed and in control.

Please note that these conclusions are based on a summary of the user reviews, and individual experiences may vary.

Based on the users' reviews of the Porte Banking app, here are three cons and three pros, each within a 15-word limit:

**Cons:**

1. Many users complain about frequent login issues and app crashing.

2. Difficulty in cancelling subscriptions and unwanted charges reported.

3. Limited features and functionality compared to other apps.

**Pros:**

1. Users appreciate the user-friendly interface and easy account management.

2. Many praise the app's security and encryption features for safe transactions.

3. Real-time updates and notifications keep users informed and in control.

Please note that these conclusions are based on a summary of the user reviews, and individual experiences may vary.

>

App

Survey

- What is the number of APPs on your phone?

- Do you think the payment of application features affects the experience?

- Ease of use of the application Does it affect the experience?

- Does the frequency of application notifications affect the experience?

Description

Porte is the mobile finance app built for you. Enjoy no monthly account fees,⁴ contactless debit card, virtual cards, charitable giving,⁵ and Direct Deposit that pays you up to 2 days faster.³ Own your money and your future with Porte.

Some of the many reasons why Porte should be your first choice:

• Some of the many reasons why Porte should be your first choice:

• No monthly account fee⁴

• Premium matte black Porte Visa® debit card

• Faster Pay - Get paid up to 2 days faster with Direct Deposit³

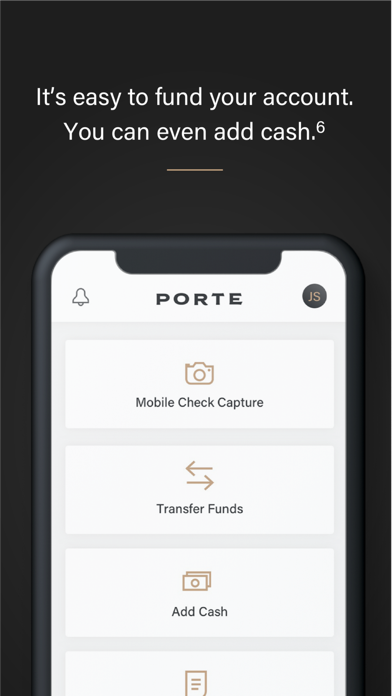

• Got cash? Add money at over 130,000 convenient reload locations⁶

• Open an Optional Savings Account¹

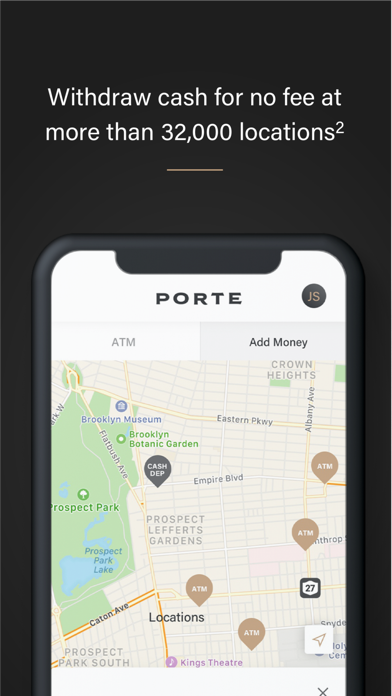

• No ATM fees at over 32,000 MoneyPass® ATMs²

• Lock/unlock your card within the app

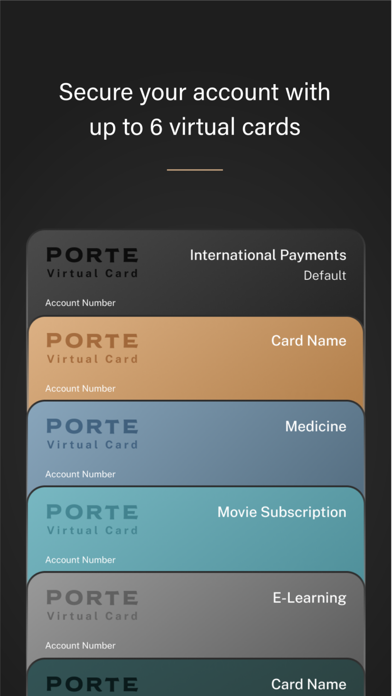

• Up to 6 virtual cards to secure your online purchases

• Apple Pay®

• Real-time balance notifications⁷

• Support a charity through Porte’s #DoorToChange⁵ program

Download today and get ready to secure your financial freedom.

For California residents, go to https://www.portebanking.com/privacy/ca/ to learn what personal information we collect and how it is used.

¹ Qualifications for the Porte Savings Account are changing. Click here for more information about the changes taking effect on 1/1/2022.

No minimum balance to open an optional Savings Account. To open a Savings Account, consent to receive communications from us in electronic form is required. Savings Account funds are withdrawn through your Porte Account (maximum 6 such transfers per calendar month). The Savings Account

linked with your Porte Account is made available to Accountholders through Metabank, N.A., Member FDIC. Funds on deposit are FDIC insured through MetaBank, N.A. For purposes of FDIC coverage, all funds held on deposit by you at MetaBank, N.A., will be aggregated up to the coverage limit, currently $250,000.00.

² No ATM owner surcharge or ATM Cash Withdrawal Fees for domestic ATM withdrawals at MoneyPass® ATMs (“in-network ATMs”). Visit the Porte Mobile App for a list of in-network ATMs. All other ATMs may apply an owner’s surcharge fee in addition to the ATM Cash Withdrawal Fee disclosed in your Deposit Account Agreement. Balance Inquiry Fees apply.

³ Based on comparison of our ACH processing policy vs. posting funds at settlement.

⁴ Other fees may apply. See your Deposit Account Agreement for details.

⁵ After selecting a charity through your Mobile App, Populus will donate an amount equal to 0.05% of every debit card purchase transaction, subject to certain terms and conditions, made with your Porte Debit Card to a charity selected by you through the Mobile App. Netspend, MetaBank, N.A., and Visa are not affiliated in any way with this offer and do not endorse or sponsor this offer.

⁶ Fee may be assessed by reload location and may vary from location to location.

⁷ No charge for this service, but your wireless carrier may charge for messages or data.

Porte is a mobile finance app, not a bank. Banking services provided by MetaBank,® N.A., Member FDIC.

PORTE is a deposit account established by MetaBank®, National Association, Member FDIC. Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787.

Comments (2)

0/255

- FBy Frankie SandersAug 20,2022

- JBy Jerriann HeathAug 19,2022

- <

- 1

- >

Category Top

apps

- Google Play

- App Store

More Apps

Ask AI

Ask AI