OS :

Version :2.1.27

Size :100.40Mb

Updated :Jan 20,2022

Developer :Centers for Medicare & Medicaid Services

Ask AI

Ask AIYou can ask

the AI some questions about the app

Based on the app's description, here are three topics that users might discuss online and I'll turn them into questions for you:

1. What makes you want to use a planner app like What's Covered?

2. How do you typically stay organized without a digital planner, and what are the benefits?

3. What features in What's Covered do you think will be most helpful for your busy life?

Pros and Cons from users' feedback

Based on the users' reviews, here are three cons and pros of the What's Covered app:

2Inaccurate information: Some users report receiving inaccurate information, which can be frustrating and unreliable.

3Slow loading: Users mention that the app takes a long time to load, making it inconvenient to use.

2Reliable source: Users appreciate the app's reliable source of information, providing accurate and trustworthy data.

3Helpful for planning: The app is useful for planning and organizing, helping users stay on top of their insurance coverage and expenses.

Cons:

1Limited coverage area: Users complain about the app's limited coverage area, making it difficult to find information.2Inaccurate information: Some users report receiving inaccurate information, which can be frustrating and unreliable.

3Slow loading: Users mention that the app takes a long time to load, making it inconvenient to use.

Pros:

1Easy to use: Many users praise the app's user-friendly interface, making it simple to navigate and find information.2Reliable source: Users appreciate the app's reliable source of information, providing accurate and trustworthy data.

3Helpful for planning: The app is useful for planning and organizing, helping users stay on top of their insurance coverage and expenses.

Based on the users' reviews, here are three cons and pros of the "What's Covered" app:

**Cons:**

1. Limited coverage area: Users complain about the app's limited coverage area, making it difficult to find information.

2. Inaccurate information: Some users report receiving inaccurate information, which can be frustrating and unreliable.

3. Slow loading: Users mention that the app takes a long time to load, making it inconvenient to use.

**Pros:**

1. Easy to use: Many users praise the app's user-friendly interface, making it simple to navigate and find information.

2. Reliable source: Users appreciate the app's reliable source of information, providing accurate and trustworthy data.

3. Helpful for planning: The app is useful for planning and organizing, helping users stay on top of their insurance coverage and expenses.

App

Downloads

>

App

Survey

- The degree of memory and power consumption Does it affect the experience?

- Whether the application ad recommendation affects the experience?

- Does the feedback of the application affect the experience?

- Does the update frequency of the application affect the experience?

Description

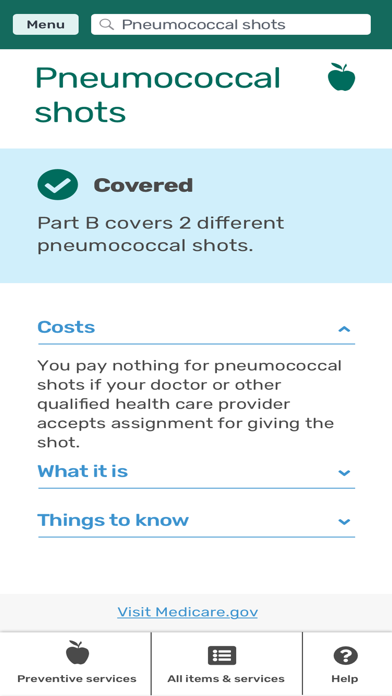

Finding information about Medicare coverage is easier than ever now. Download the only official U.S. government Medicare app onto your mobile device.

What’s covered helps you understand the health care coverage offered by Original Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

Use this federal government app to:

-Answer your Medicare coverage questions

-See information about your costs

-Learn about covered items & services

-See notes & where to get more information

-Browse free preventive services

Original Medicare Items & Services

Find out what your Medicare coverage has to offer like:

- When are mammograms covered?

- Is home health care covered?

- Will Medicare pay for diabetes supplies?

Preventive Health Coverage

Medicare coverage includes preventive services at no cost to you. Preventive services can help keep you healthy by finding health problems early and can keep you from getting certain diseases.

What’s covered will help you answer questions like:

- Will my Medicare benefits cover services to help me stop smoking?

- Can I get a cervical cancer screening?

- How often will my Medicare coverage allow me to get a bone mass measurement?

Ask your doctor or health care provider which preventive services (like screenings, shots, and tests) you need to get.

Part A & Part B Costs

Medicare Part A and Part B cover certain medical services and supplies in hospitals, doctors’ offices, and other health care settings.

Part A hospital insurance coverage helps pay for inpatient care in a hospital, inpatient care in a skilled nursing facility, hospice care, home health care, or inpatient care in a religious nonmedical health care institution. Copayments, coinsurance, or deductibles may apply for each service.

Part B medical insurance coverage supports medically necessary doctors’ services, outpatient care, home health services, durable medical equipment, preventive services, and other medical services. Under Original Medicare, if the Part B deductible applies, you must pay all health care costs (up to the Medicare-approved amount) until you meet the yearly Part B deductible. After your deductible is met, Medicare begins to pay its share and you typically pay 20% of the Medicare-approved amount of the service, if the doctor or health care provider accepts assignment. There’s no yearly limit for what you pay out-of-pocket.

For some items and services, you must meet eligibility criteria or you may be responsible for paying all costs. Your doctor or health care provider may recommend you get services more often than Medicare covers. Or, they may recommend services that Medicare doesn’t cover. If this happens, you may have to pay some or all of the costs. Ask questions so you understand why your doctor is recommending certain services and whether Medicare will pay for them.

Use the What’s covered app to answer questions like:

-How much will I pay for prescription drugs included in Medicare Part B coverage?

-Does the Part B deductible apply for cardiac rehab?

-What percentage of the Medicare-approved amount will I need to pay for colorectal cancer screenings?

What’s Not Included

What’s covered doesn’t contain information on Medicare Advantage Plan, other Medicare health plan, or Medicare Supplement Insurance (Medigap) coverage. It doesn’t contain a CPT code search, exact costs on surgeries or procedures, or local coverage decisions.

Medicare Advantage Plans

If you have a Medicare Advantage Plan or other Medicare health plan, you have the same basic health care coverage as people who have Original Medicare, but the rules vary by plan. Some Medicare Advantage Plans offer extra benefits that Original Medicare doesn’t cover - like vision, hearing, or dental. Check with the plan or search in the App Store to see if the plan has a similar mobile application.

This is Medicare’s first official app, and we value your feedback. Please tell us your thoughts by rating What’s covered.

Comments (0)

0/255

Category Top

apps

- Google Play

- App Store

More Apps

Ask AI

Ask AI