OS :

Version :6.2.1

Size :31.67Mb

Updated :Feb 19,2022

Developer :NETSPEND CORPORATION

Ask AI

Ask AIYou can ask

the AI some questions about the app

Here are three topics related to Netspend that users often discuss on the internet, turned into questions:

1. What are the fees associated with using Netspend, and how can I avoid them?

2. How does Netspend's direct deposit feature work, and what is the timeline for receiving my payments?

3. Can I link my Netspend account to other financial apps or services, such as budgeting tools or investment accounts?

Pros and Cons from users' feedback

Based on the users' reviews of the Netspend app, here are three cons and pros:

2Fees are high and unclear, causing surprise charges.

3Mobile deposit limits are low and inconvenient.

2Good variety of payment options and vendors.

3Mobile app is reliable and rarely crashes.

Please note that these are based on a quick scan of the reviews and might not represent the opinions of all users.

Cons:

1Customer service is horrible. They ignore emails and don't respond to calls. 2Fees are high and unclear, causing surprise charges.

3Mobile deposit limits are low and inconvenient.

Pros:

1Easy to use and navigate, even for seniors. 2Good variety of payment options and vendors.

3Mobile app is reliable and rarely crashes.

Please note that these are based on a quick scan of the reviews and might not represent the opinions of all users.

Based on the users' reviews of the Netspend app, here are three cons and pros:

**Cons:**

1. "Customer service is horrible. They ignore emails and don't respond to calls." (7 words)

2. "Fees are high and unclear, causing surprise charges." (7 words)

3. "Mobile deposit limits are low and inconvenient." (7 words)

**Pros:**

1. "Easy to use and navigate, even for seniors." (7 words)

2. "Good variety of payment options and vendors." (7 words)

3. "Mobile app is reliable and rarely crashes." (7 words)

Please note that these are based on a quick scan of the reviews and might not represent the opinions of all users.

App

Downloads

>

App

Survey

- Does the update frequency of the application affect the experience?

- Application interactivity Does it affect the experience?

- Why do you uninstall an app?

- How much traffic the app consumes Does it affect the experience?

Description

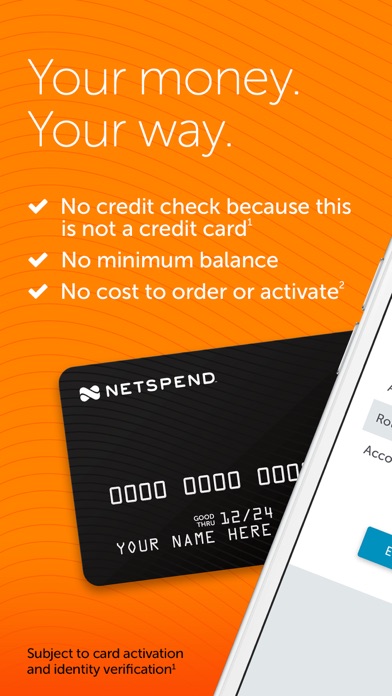

With the Netspend Prepaid Card, you’re in charge.

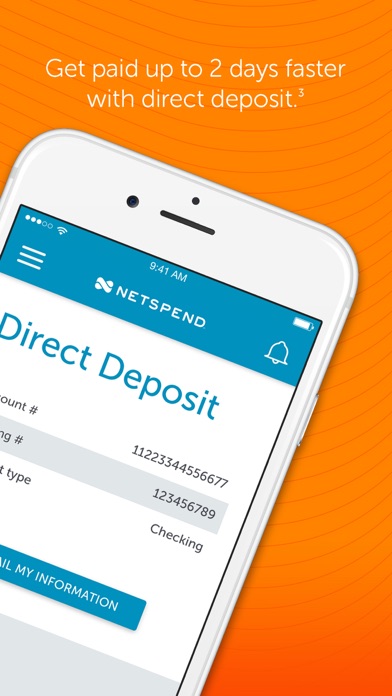

Features like direct deposit offer a convenient way to add money to your Card Account and get paid up to 2 days faster.³ Use your card anywhere Visa® debit cards or Debit Mastercard® is accepted. And with the Netspend Mobile App⁶ you can manage your account wherever you go. You’ll be able to do things like:

• Load checks directly to your Card Account—just by taking a few pictures.⁴

• Check your Card Account balance and transaction history.

• Send money to friends and family.

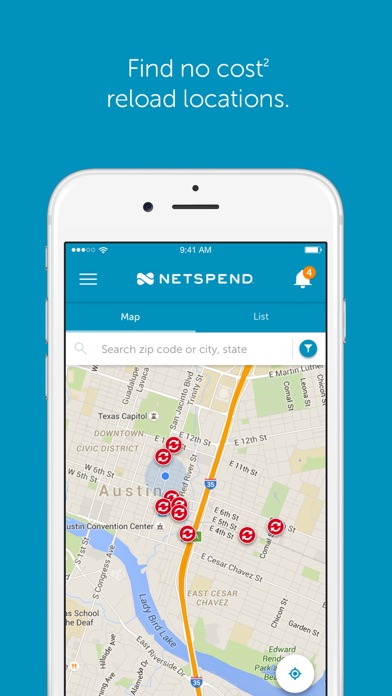

• Find no cost reload locations.²

With the Mobile App⁶ it’s all at your fingertips.

1 ID verification required. We will ask for your name, address, date of birth, and your government ID number. We may also ask to see your driver’s license or other identifying information. Card use restrictions may apply. See netspend.com or card order page for details. Residents of Vermont are ineligible to open a card account.

2 While this feature is available at no cost, certain other transaction fees and costs, terms and conditions are associated with the use of this Card. See the Cardholder Agreement.

3 Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction versus the typical banking practice of posting funds at settlement. Fraud prevention restrictions may delay availability of funds with or without notice. Early availability of funds requires payor’s support of direct deposit and is subject to the timing of payor’s payment instruction.

4 Mobile Check Load is a service provided by First Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions, and Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card. Unapproved checks will not be funded to your card. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for message and data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card. See your Cardholder Agreement for details.

5 Fees for bank transfers are determined by the transferor’s bank and may be charged to the transferor’s bank account by the service provider or originating bank. No cost for online or mobile Account-to-Account transfers between Netspend Cardholders; a $4.95 Account-to-Account Transfer Fee-CS Agent applies.

6 Netspend does not charge for this service, but your wireless carrier may charge for messages or data.

The Netspend Visa Prepaid Card is issued by Axos Bank®, The Bancorp Bank, MetaBank®, and Republic Bank & Trust Company, pursuant to a license from Visa U.S.A. Inc. The Netspend Prepaid Mastercard is issued by Axos Bank, The Bancorp Bank, MetaBank, and Republic Bank & Trust Company pursuant to license by Mastercard International Incorporated. Axos Bank, The Bancorp Bank, MetaBank, and Republic Bank & Trust Company; Members FDIC. Please see back of your Card for its issuing bank. Netspend, a TSYS® Company, is a registered agent of Axos Bank, The Bancorp Bank, MetaBank, and Republic Bank & Trust Company. The Netspend Visa Prepaid Card may be used everywhere Visa debit cards are accepted. The Netspend Prepaid Mastercard may be used everywhere Debit Mastercard is accepted. Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787. Use of the Card Account is subject to activation, ID verification, and funds availability. Transaction fees, terms and conditions apply to the use and reloading of the Card Account. See Cardholder Agreement for details.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Comments (5)

0/255

- PBy Pocket momSep 21,2018

- JBy JuiceyMo3Aug 17,2022

- qBy qubitzillaNov 4,2020

- IBy I need a nickname 123Sep 18,2019

- LBy Lola@ShortyJan 28,2021

- <

- 1

- >

Developer apps

Category Top

apps

- Google Play

- App Store

More Apps

Ask AI

Ask AI