OS :

Version :7.34.0+3/6.4.51

Size :/355.01Mb

Updated :Nov 14,2022

Aug 11,2022

Aug 11,2022

Developer :Intuit Inc

Ask AI

Ask AIYou can ask

the AI some questions about the app

Here are three topics that users may discuss about the QuickBooks Self-Employed app, turned into questions:

1. How do you find the mobile app's user interface and navigation?

2. Are the financial tracking and organization features sufficient for your business needs?

3. Have you experienced any issues with syncing data between the app and your bank accounts?

Pros and Cons from users' feedback

After analyzing the user reviews of the QuickBooks Self-Employed app, here are the conclusions:

2Automated expense tracking saves me a lot of time and effort daily.

3Constantly updated features meet my evolving business needs effectively.

2Some features, like tax preparation, are not as robust as expected.

3Buggy updates sometimes cause app crashes and data loss worries.

Note: The reviews were analyzed based on the 10,000+ reviews available on the Google Play Store page of the QuickBooks Self-Employed app. The conclusions were drawn from a general pattern and trends in the user feedback.

Pros:

1User-friendly interface helps me manage my finances easily and accurately.2Automated expense tracking saves me a lot of time and effort daily.

3Constantly updated features meet my evolving business needs effectively.

Cons:

1Limited banking integration options cause frustration and extra work manually.2Some features, like tax preparation, are not as robust as expected.

3Buggy updates sometimes cause app crashes and data loss worries.

Note: The reviews were analyzed based on the 10,000+ reviews available on the Google Play Store page of the QuickBooks Self-Employed app. The conclusions were drawn from a general pattern and trends in the user feedback.

After analyzing the user reviews of the QuickBooks Self-Employed app, here are the conclusions:

**Pros:**

1. "User-friendly interface helps me manage my finances easily and accurately."

2. "Automated expense tracking saves me a lot of time and effort daily."

3. "Constantly updated features meet my evolving business needs effectively."

**Cons:**

1. "Limited banking integration options cause frustration and extra work manually."

2. "Some features, like tax preparation, are not as robust as expected."

3. "Buggy updates sometimes cause app crashes and data loss worries."

Note: The reviews were analyzed based on the 10,000+ reviews available on the Google Play Store page of the QuickBooks Self-Employed app. The conclusions were drawn from a general pattern and trends in the user feedback.

>

App

Survey

- What is your Mobile System?

- Does the feedback of the application affect the experience?

- Do you think the stability of the application affects the experience?

- Does the frequency of application notifications affect the experience?

Description

Are you self-employed, a freelancer or an independent contractor? Organize your finances with QuickBooks Self-Employed and let us help you find your tax deductions & maximize tax returns in time for tax season!.Put more money in your pocket with this convenient mile tracker, expense tracker and tax deductions estimator.

QuickBooks Self-Employed users have found billions in potential tax deductions by using the automatic mileage tracker, organizing business expenses by category and attaching receipts to the correct transactions.

Track Mileage Automatically!

• Mileage tracking automatically works using your phone’s GPS, without draining your phone’s battery.

• Trip mileage is saved and categorized to maximize mileage tax deductions.

Scan Receipts

• The receipt scanner extracts important transaction information and automatically matches to a business expense so you're always ready for tax time.

• Store a digital copy of your receipt in the cloud

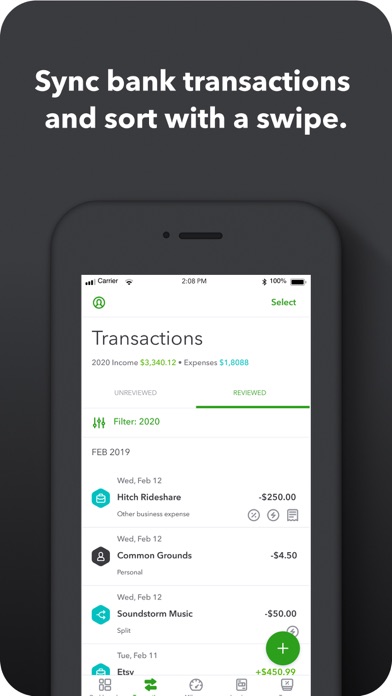

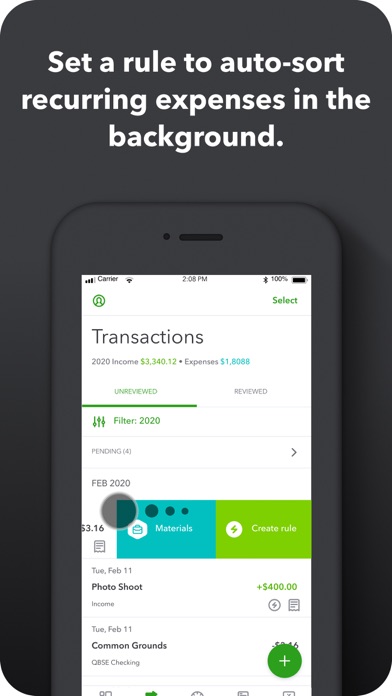

Expense Tracker to Organize Business Expenses

• Self -employed, freelancer or small business owner – manage business finances easily and keep up to date so you do not miss out on any tax deductions.

• Import business expenses directly from your bank account.

Stay Prepared For Tax Time

• We take care of your bookkeeping so you can avoid year-end surprises

• Easily organize income and business expenses for instant tax filing

• Directly export Schedule C income and expenses.

• Instantly export your financial data to TurboTax Self-Employed by upgrading to the Tax bundle*.

*Users will receive one state and one federal tax return filing.

Purchased TurboTax Self-Employed? Activate QuickBooks Self-Employed today at no extra cost

Already have QuickBooks Self-Employed on the web? The mobile app is FREE with your subscription, and data syncs automatically across devices. Just download, sign in, and go!

Price, availability and features may vary by location. Subscriptions will be charged to your credit card through your account. Your subscription will automatically renew unless canceled at least 24 hours before the end of the current period. Manage your subscriptions in Account Settings after purchase. QuickBooks Self-Employed is from Intuit, the maker of TurboTax, QuickBooks, and Mint.

To learn how Intuit protects your privacy, please visit https://www.intuit.com/privacy/

*Based on QuickBooks Self-Employed users who have identified less than $100k in deductions

*Based on TY15 subscribers that have identified >$0 in business expenses and of those users that have >$0 in tax savings

*Getting paid 2X faster based on U.S. customers using QuickBooks Online invoice tracking & payment features from August 2016 to July 2017

QuickBooks Self-Employed users have found billions in potential tax deductions by using the automatic mileage tracker, organizing business expenses by category and attaching receipts to the correct transactions.

Track Mileage Automatically!

• Mileage tracking automatically works using your phone’s GPS, without draining your phone’s battery.

• Trip mileage is saved and categorized to maximize mileage tax deductions.

Scan Receipts

• The receipt scanner extracts important transaction information and automatically matches to a business expense so you're always ready for tax time.

• Store a digital copy of your receipt in the cloud

Expense Tracker to Organize Business Expenses

• Self -employed, freelancer or small business owner – manage business finances easily and keep up to date so you do not miss out on any tax deductions.

• Import business expenses directly from your bank account.

Stay Prepared For Tax Time

• We take care of your bookkeeping so you can avoid year-end surprises

• Easily organize income and business expenses for instant tax filing

• Directly export Schedule C income and expenses.

• Instantly export your financial data to TurboTax Self-Employed by upgrading to the Tax bundle*.

*Users will receive one state and one federal tax return filing.

Purchased TurboTax Self-Employed? Activate QuickBooks Self-Employed today at no extra cost

Already have QuickBooks Self-Employed on the web? The mobile app is FREE with your subscription, and data syncs automatically across devices. Just download, sign in, and go!

Price, availability and features may vary by location. Subscriptions will be charged to your credit card through your account. Your subscription will automatically renew unless canceled at least 24 hours before the end of the current period. Manage your subscriptions in Account Settings after purchase. QuickBooks Self-Employed is from Intuit, the maker of TurboTax, QuickBooks, and Mint.

To learn how Intuit protects your privacy, please visit https://www.intuit.com/privacy/

*Based on QuickBooks Self-Employed users who have identified less than $100k in deductions

*Based on TY15 subscribers that have identified >$0 in business expenses and of those users that have >$0 in tax savings

*Getting paid 2X faster based on U.S. customers using QuickBooks Online invoice tracking & payment features from August 2016 to July 2017

Comments (4)

0/255

- DBy David RingSep 2,2022

- BBy Barney SawyerSep 2,2022

- HBy Heather JordanSep 2,2022

- PBy Peter KnowlesSep 1,2022

- <

- 1

- >

Developer apps

- Google Play

- App Store

Category Top

apps

- Google Play

- App Store

More Apps

Ask AI

Ask AI